Measurement: When the Data Moves, What Changes?

Early in my CPG career, a 0.6-point share dip after a major launch sent me into two weeks of scenario modeling.

The business wasn’t broken. But we were treating a lagging metric like an operational lever.

That experience shaped how I think about measurement in annual planning.

Measurement isn’t reporting. It’s enforcement.

OGS(P)T: The Planning Framework with a Spine

Every planning cycle, teams align on growth. Then the first efficiency conversation quietly rewrites the strategy — and innovation gets cut first. Here's the framework that forces you to decide what matters before the metrics do.

Moneyball for Marketers: The Conviction Layer

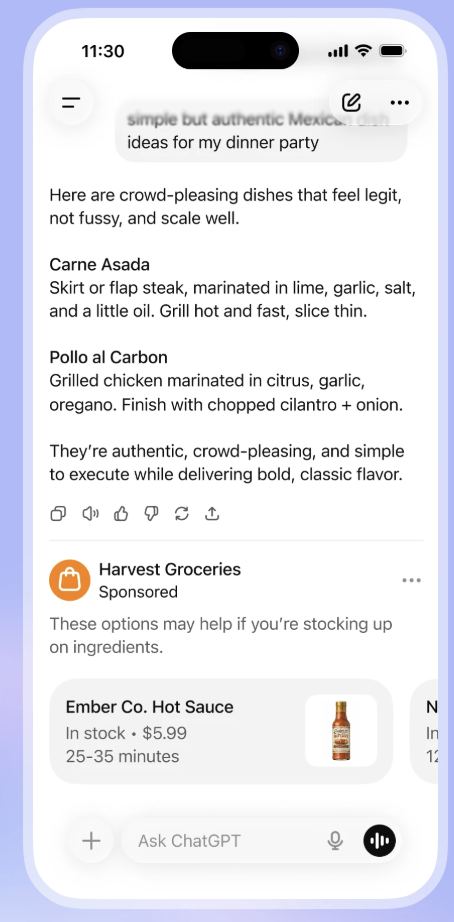

ChatGPT's Ad Go-To-Market is Backwards

OpenAI just launched ChatGPT ads with $60 CPMs and $200K minimums — targeting big CPG brands with no ROI framework, no measurement plan, and no brand safety controls.

They went after the most conservative ad spenders in the most budget-constrained environment in years, asking them to bet on a channel their brands aren't even optimized for.

It's backwards — and here's why it slows down proof of concept for everyone.

ChatGPT Ads Are Here. How Challenger Brands Win Anyway

ChatGPT just started testing paid placements at $60 CPMs with no clear ROI framework or brand safety controls — but that's not the interesting part.

The Full “Make Money, Darling!” Planning Series

The full “Make Money, Darling!” 2026 Planning Series (In order)

The 5 Insight Decks you Absolutely Need to guide your strategy for scaling CPG brands

Most CPG brands skip consumer insights because they think it requires a Fortune 500 budget—but you can get 70-80% of the way there with five foundational decks built scrappily. Here's how to stop making six-figure bets without knowing who you're actually selling to.

The Onomatopoeia Effect

Most CPG brands overlook their most defensible assets: the sensory moments their formulation, packaging, or ingredients already create.

Pringles owns the "pop," Snapple the "snap"—but these weren't invented, they were noticed.

Challenger brands have distinctive experiences built into their products that could become ownable brand assets, yet most aren't naming or building around them.

Why ‘Defining the Business Challenge’ Is Where Plans Live or Die

The most skipped step in annual planning? Diagnosing the business challenge, or where the business actually needs to win.

I've seen teams execute flawlessly—against the wrong constraint.

Two CPG stories that show the difference between aspirational and contextual challenges.

What Managing a Declining Brand Taught Me About Audits. Hint: Not Optimism.

I got promoted to manage a declining brand in year 3 of YoY losses.

Not glamorous. But it taught me more about marketing than any winning brand ever could.

Here's the audit framework that found a 40% distribution increase.

From Insight Strategy to Media Targeting: Why the Translation Layer Matters

Most CPG brands don’t stall because competitors outspend them — they stall because they misread what’s actually happening in the category. At the $5–$30M stage, the problem isn’t lack of data, it’s knowing which signals matter and which ones are just noise.

This piece breaks down how category and competitive intelligence should inform real growth decisions — from positioning and pricing to channel focus and sequencing — so teams stop reacting and start making clearer, more disciplined bets.

Category & Competition: How to Read the Signals That Matter

How to see the landscape clearly without letting competitors define your strategy.

This piece breaks down how category and competitive intelligence should actually inform growth decisions — from pricing and positioning to channels and sequencing — so teams stop reacting to noise and start making disciplined bets as the category evolves.

Consumer Questions Every 2026 Plan Should Answer

Most CPG brands skip straight to tactics—channels, creative, retail strategy—without answering the foundational question: Who is this actually for?

Before you set revenue goals or pick marketing channels, you need clarity on your consumer. Not demographics. Not personas that sound good in a deck. Real human understanding—the kind that shapes every decision from product development to media spend.

The 5-Minute AI Visibility Test

Go to ChatGPT. Type in the problem your product solves. Does your

ChatGPT Is Recommending Your Competitors (Not You)

Go to ChatGPT right now. Type in the problem your product solves. (Example: "What's the best high-protein pasta for meal prep?" or "Best pasta alternatives for someone trying to build muscle?")

Are you in the top 3 brands it recommends? If not, find out how challenger brands can win in AEO.

10 Macro Trends Shaping 2026 Marketing

2026 won’t behave like 2025. And I’m pretty sure nobody else has “Ariana Grande foreshadowed TikTok Shop” on their 2026 bingo card — but stay with me, because it matters.

Consumer behavior is shifting fast. The brands that win in 2026 aren’t the ones who react fastest, they’re the ones who plan around the forces reshaping the market (and happen to follow my planning advice).

These are the 10 macro forces I predict will shape how consumers discover, evaluate, and buy in 2026 and what they mean for your brand.

2026 Marketing Planning Starts Now

Big CPG trained me to start with the consumer. DTC taught me how that consumer actually behaves across retail, Amazon, DTC, and now AI-led discovery. 2026 planning requires both. Most brands only have one.

So over the next few weeks, I’m breaking down the components of how I’d plan 2026 — the kind operators at $5M–$50M brands actually need to hit next year’s growth targets.

What I Fix Inside $5M–$50M CPG Brands (And How)

Most $5M–$50M DTC and CPG brands don’t stall because of channels or creative. They stall because the commercial engine stops working as one system. Here’s what actually breaks — and what to fix first.

How to Build a Performance-Driven Influencer Program That Scales

Most influencer programs rely on luck, not strategy. This breakdown shows how I transformed one organic creator win into a repeatable, performance-first growth engine using affiliate validation, whitelisting, and selective creator partnerships.